Grades 6-8

Don't have an account yet? Sign up for free

Don't have an account yet? Sign up for free

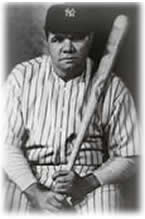

This lesson demonstrates a method for teaching students about inflation and the Consumer Price Index, using baseball players’ salaries for purposes of illustration. Babe Ruth’s salary from 1931 is adjusted to account for changes in the price level and is then compared to the salaries of those playing major league baseball players today.

In 1931, Babe Ruth made $80,000 per year. Was the Great Bambino overpaid or underpaid according to today’s standards? On average, Major League Baseball (MLB) players in 2025 earn $5.2 million per year. This lesson will provide you with tools for answering this question. [Explain to the students that prices have also risen over this time period making this question more complicated than it appears.] Determine whether Babe Ruth was overpaid or underpaid in comparison to today’s MLB players. This question can be answered by using the Consumer Price Index (CPI) to adjust Ruth’s salary for changes in the price level.

In 1931, Babe Ruth made $80,000 per year. Was the Great Bambino overpaid or underpaid according to today’s standards? On average, Major League Baseball (MLB) players in 2025 earn $5.2 million per year. This lesson will provide you with tools for answering this question. [Explain to the students that prices have also risen over this time period making this question more complicated than it appears.] Determine whether Babe Ruth was overpaid or underpaid in comparison to today’s MLB players. This question can be answered by using the Consumer Price Index (CPI) to adjust Ruth’s salary for changes in the price level.

The Consumer Price Index (CPI) can be used to compare dollar figures from different times accurately. The students may have heard their grandparents telling them that they remember when a gallon of gas cost 50 cents or a loaf of bread cost a quarter (way back in the 1960’s). But those numbers by themselves don’t tell us how expensive things were in the old days compared to now. It’s the same with salary figures from the past. For example in 1931 when Babe Ruth had a batting average of .373 with 46 home runs and 163 RBIs, an ice-cream cone cost five cents and going to a movie in a theater cost a quarter. Ruth’s salary then was $80,000 per year. But it is not clear from that salary figure alone whether Ruth enjoyed better or worse purchasing power than today’s players.

In order to investigate this question, a couple of concepts from economics must be introduced. First, the inflation rate: It is the percentage of increase in the price level of the economy as measured by the CPI. The CPI tracks the overall price change for a fixed basket of goods and services bought by a typical working-class urban family over time. It is a measure of price changes in consumer goods – also known as the “cost of living index.” The CPI “basket” contains goods and services that have been chosen for the CPI survey. Imagine a shopping basket loaded up with fruit, chocolate, meat, chips and other items from each of the nine groups of goods and services used in the CPI. The items in the basket must be identical in quantity and quality over a period of time. Some changes in prices may be due to increased quality or improved packaging, but these are not “pure” price changes. When this happens, price adjustments are made to remove the effect of these changes.

In order to investigate this question, a couple of concepts from economics must be introduced. First, the inflation rate: It is the percentage of increase in the price level of the economy as measured by the CPI. The CPI tracks the overall price change for a fixed basket of goods and services bought by a typical working-class urban family over time. It is a measure of price changes in consumer goods – also known as the “cost of living index.” The CPI “basket” contains goods and services that have been chosen for the CPI survey. Imagine a shopping basket loaded up with fruit, chocolate, meat, chips and other items from each of the nine groups of goods and services used in the CPI. The items in the basket must be identical in quantity and quality over a period of time. Some changes in prices may be due to increased quality or improved packaging, but these are not “pure” price changes. When this happens, price adjustments are made to remove the effect of these changes.

We can also distinguish between current dollars and constant dollars. The value of the income (or purchase) at the time it was actually earned (or spent) is measured in current dollars. Current dollars are dollars from other time periods converted into present-day dollars, in order to factor out the effects of inflation. Adjusting a current dollar figure to show the impact of inflation on the purchasing power converts the figure into constant dollars. Constant dollars eliminate the changes in the purchasing power of the dollar over time. The result is a series as it would exist if the dollar had a purchasing power equal to its purchasing power in the base year. For example, it is more useful to compare the change in annual wages measured in constant dollars than in current dollars because of the effect of inflation on purchasing power. While wages in current dollars may have risen over time, wages in constant dollars may have declined because prices of goods and services that workers bought rose more than wages.

Given all of this, how do we actually make the comparison? Well, this is done using a simple formula as follows:

Note: * = multiplication

Salary in Constant Dollars (Recent Year) = Salary in Current Dollars (Old Year)*(CPI in Recent Year/CPI in Old Year)

[Using data on the consumer price index from the CPI page in the resources and here we can determine what Ruth’s constant dollar salary was as follows:

Ruth salary in 2022 Constant Dollars= Ruth Salary in 1931 Current Dollars * (CPI in June 2025/CPI in 1931) Adjust the current CPI depending on when you use this lesson. See CPI link in resources.

$1,694,737 = $80,000 * (322/15.2)

[Ruth’s salary in constant 2025 dollars was about $1.7 million per year. This is a sgnificantly less than the average baseball player makes today ($5.1 million in 2025), and much less than the stars make (Juan Soto of the N.Y. Mets was the highest-paid MLB Player in 2025 at $126 million per year).

This lesson introduces the idea of inflation and the consumer price index. Students learn how to adjust dollar figures from previous times and compare them to dollar figures today by using a formula or by using the inflation calculator.

Show the students this Inflation Calculator from the Federal Reserve Bank of Minneapolis.

Have the students choose a dollar amount and year: the calculator will determine what that dollar amount is worth in today’s dollars.

Have the students answer the following questions using the formula [Salary in Constant Dollars (Recent Year) = Salary in Current Dollars (Old Year)*(CPI in Recent Year/CPI in Old Year)], https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1800- and the CPI Inflation Calculator.

[Answers may vary slightly due to rounding. These are also June 2025 inflation statistics. If you are using this lesson after June 2025, use the inflation calculator and change the answers.]

President Hoover made $75,000 per year in 1931. President Biden earned $400,000 in 2022. Who earned more in 2022 dollars?

Use the inflation formula (not a calculator) to answer this question.

[$1,470,395 = $75,000 * (298/15.2)

Hoover was paid significantly more than Biden when changes in the price level are considered.]

Grades 6-8

Grades 9-12

Grades 9-12

Grades K-2, 3-5